30+ debt to income ratio mortgage

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly.

Tougher Times For Home Loan Approvals Japan Property Central K K

Web Your debt-to-income DTI ratio is the percentage of gross income before taxes are taken out that goes toward your debt.

. Web In general lenders prefer that your back-end ratio not exceed 36. Apply Now With Quicken Loans. If your home is highly energy-efficient.

Web How to calculate your debt-to-income ratio. Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or. Ad Compare Best Mortgage Lenders 2023.

Lock Your Mortgage Rate Today. Ideally lenders prefer a debt-to-income ratio. Web To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card.

That means if you earn 5000 in monthly gross income your total debt obligations should be. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances. Web Here are debt-to-income requirements by loan type.

But each mortgage lender can set its own eligibility requirements and DTI. Ad Compare Mortgage Options Calculate Payments. Youll usually need a back-end DTI ratio of 43 or less.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Were Americas Largest Mortgage Lender. Ad Compare Mortgage Options Calculate Payments.

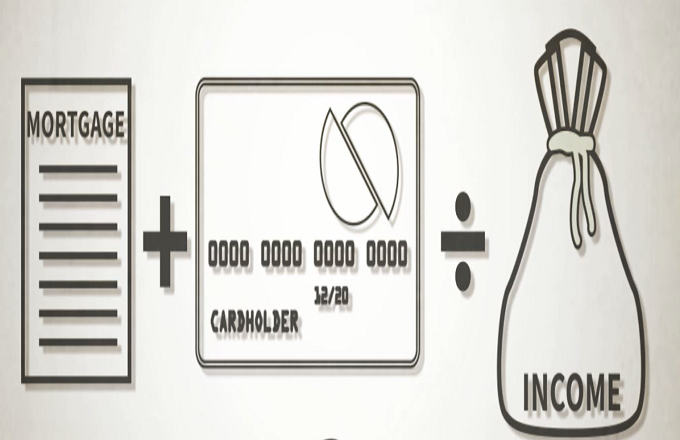

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. The most common term for a mortgage is 30 years or 360 months but different. Web What is a Debt-to-Income Ratio.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Simple definition. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Choose a longer time period to pay off your. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Ad We Offer Competitive Mortgage Rates Fees.

Apply Now With Quicken Loans. Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43. Were Americas Largest Mortgage Lender.

Web Web Calculating your DTI Ratio Simply enter your monthly gross income pre-tax and your monthly debt expenses into the calculator below to find out your DTI ratio. Apply Online Get Pre-Approved Today. Bank Mortgage Application Anytime Anywhere Connect With A Loan Officer.

Web You can get an estimate of your debt-to-income ratio using our DTI Calculator. Lock Your Mortgage Rate Today.

Form 8 K Bank Of America Corp For Oct 14

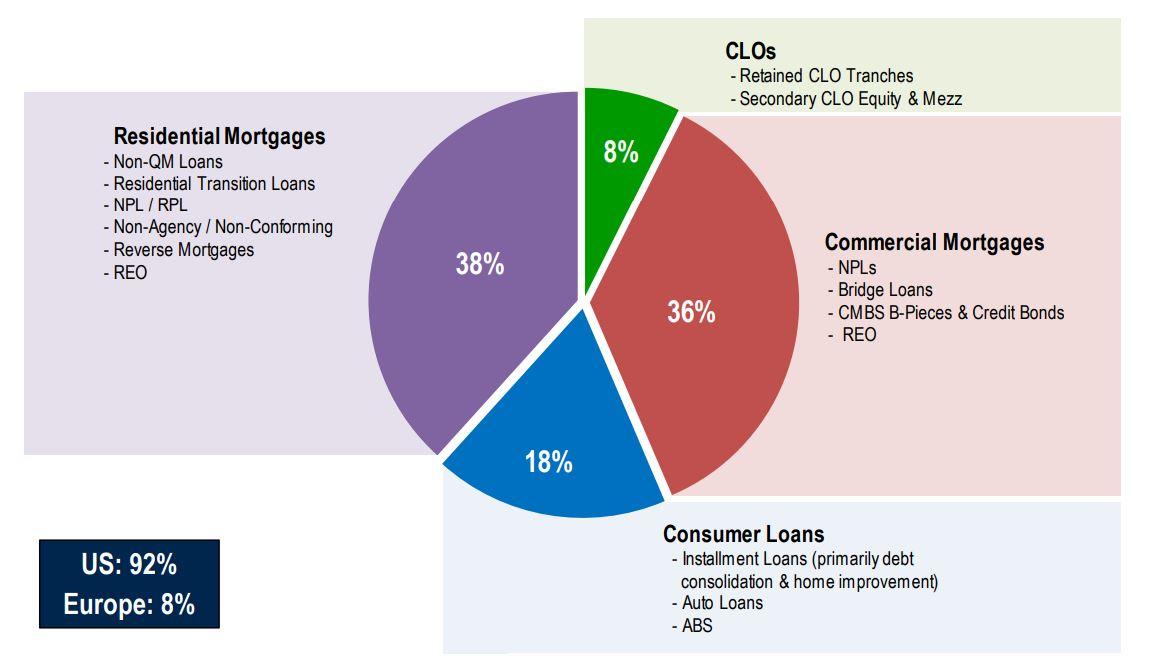

Back To The Future A Brief Journey Through The Past Present And Future Of Securitization The Journal Of Structured Finance

Investing In Real Estate Module 7 Of Family Financial Freedom

Should I Choose A 30 Year Fixed Or Adjustable Rate Mortgage Quora

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Debt To Income Ratio For Mortgage Definition And Examples

Non Qualified Mortgage Loans Summertime Blues Continue Despite Improved July Delinquencies S P Global Ratings

Rising Council Debt Across New Zealand

What Is An Acceptable Debt To Income Ratio Hoyes Michalos

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio For Mortgage Calculation And Discussion Youtube

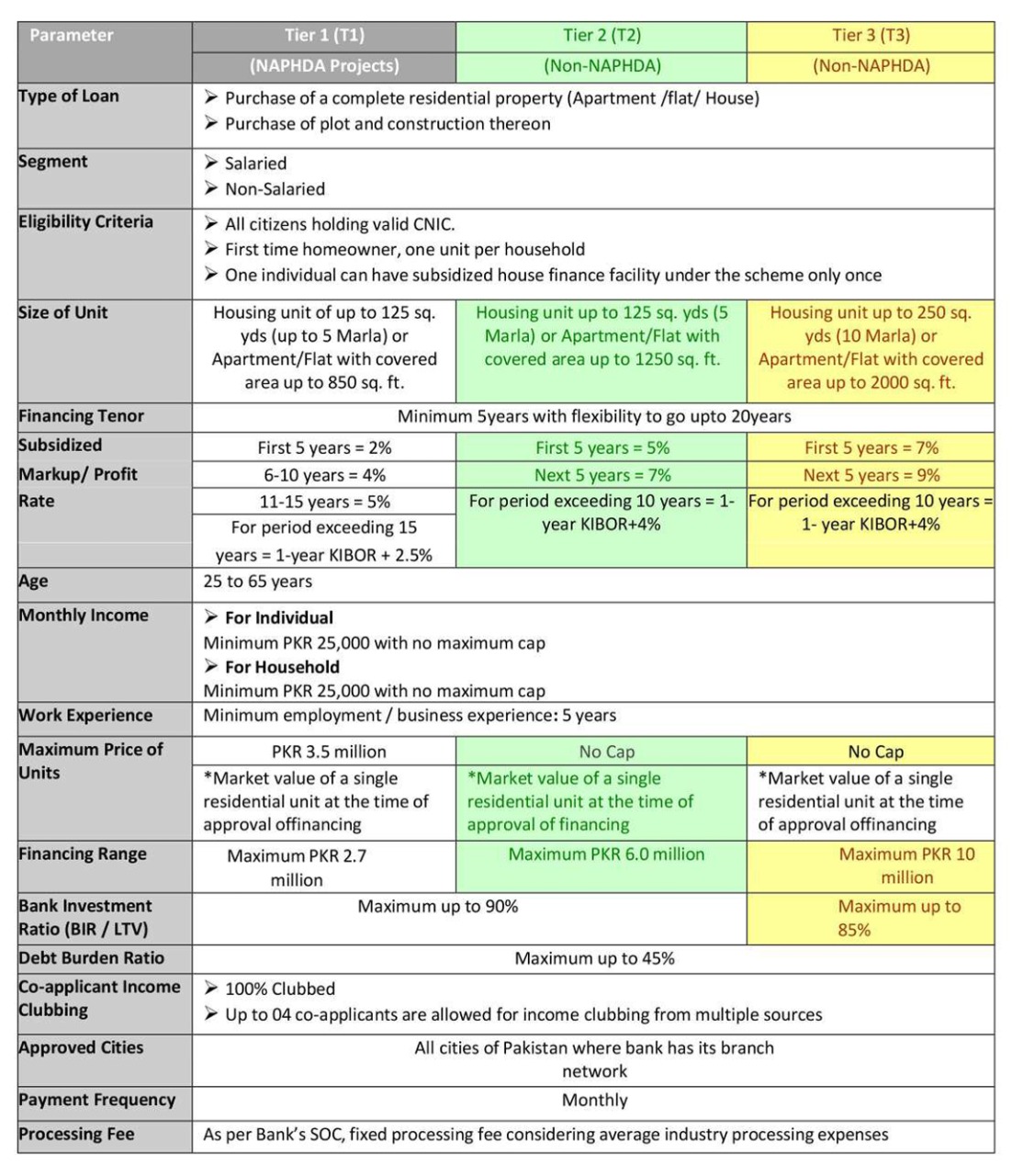

Mortgage Process Guideline Saste Se Sasta

What Is A Good Debt To Income Dti Ratio

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Calculated Risk Fed Household Debt Service Ratio Near Lowest Level In 30 Years

Mortgage Lender Woes Wolf Street

Ellington Financial High Dividend Yield Comes With Risk Nyse Efc Seeking Alpha